Voluntary Benefits

Short Term & Long Term Disability, Accident, Critical Illness, Infectious Disease, Hospital Indemnity and Wellness insurance coverages are available to you, your spouse, and your dependent children. However, employees must elect coverage for these Voluntary Benefits in order for their spouse and children to obtain coverage.

Voluntary Benefits are just that, voluntary. The costs for voluntary benefits are 100% paid by the employee.

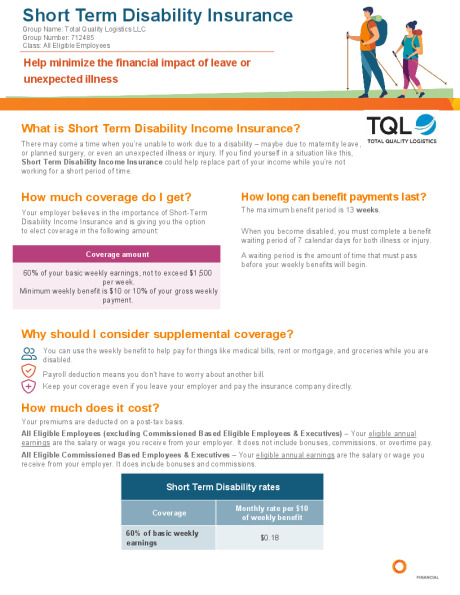

Voluntary Short Term Disability Insurance

Total Quality Logistics offers a short-term disability option through Voya. This benefit covers 60% of your weekly base salary up to $1,500/week. The benefit begins after 7 days of injury or illness and lasts up to 13 weeks. Please see the summary plan description for complete plan details.

| VOYA VOLUNTARY SHORT-TERM DISABILITY | |

|---|---|

| Benefit Amount | 60% |

| Benefit Max | $1,500/week |

| Benefits Begin Accident / Sickness | 7th day / 7th day |

Video: Disability Insurance

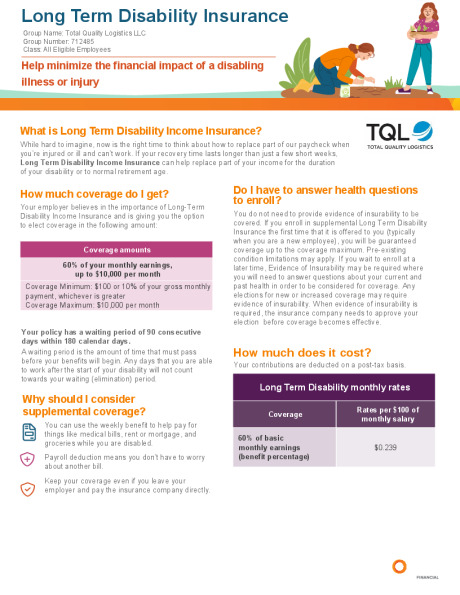

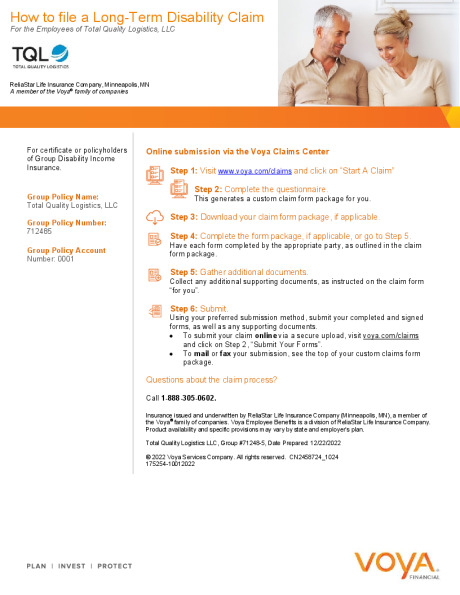

Voluntary Long Term Disability Insurance

Total Quality Logistics offers long-term income protection through Voya in the event you become unable to work due to a non-work-related illness or injury. This benefit covers 60% of your monthly base salary up to $10,000. Benefit payments begin after 90 days of disability.

See Certificate of Coverage for benefit duration. Please see the summary plan description for complete plan details.

| VOYA LONG-TERM DISABILITY | |

|---|---|

| Benefit Amount | 60% |

| Benefit Max | $10,000/month |

| Benefits Begin Accident / Sickness | 90 days |

| Own Occupations Period/Maximum Benefit Duration | 24 months/social security normal retirement age or age 65 (whichever is later) |

| Pre-Existing Limitations | * Exclusion for a sickness or injury for which the insured employee received treatment within 3 months prior to his/her effective date of this treatment |

| * Benefits are not payable if your disability begins in the first 12 months after your coverage effective date, and your disability is caused by, contributed by, or the results of a pre-existing condition. |

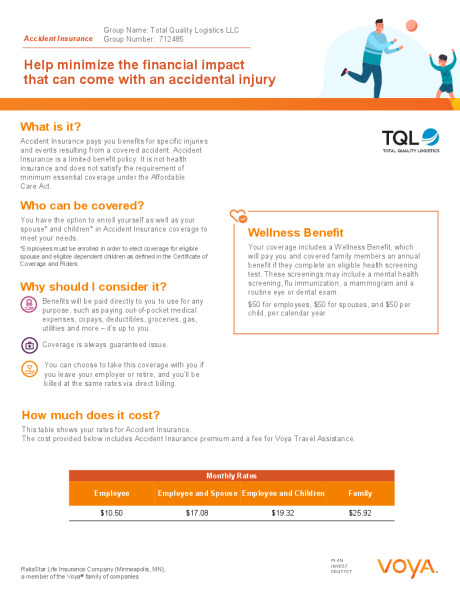

Voluntary Accident Insurance

Total Quality Logistics provides eligible employees with Accident Insurance through Voya.

Group Name: Total Quality Logistics, LLC.

Group Number: 0071248-5

Class: Full-Time and Part -Time Employees

Accident Insurance provides a benefit payment after a covered accident that results in the specific injuries and treatments listed in the document referenced below.

In the event of a covered accident, Accident Insurance with Voya pays cash benefits fast to help with the costs associated with out-of-pocket expenses and bills. Accident Insurance covers over 50 benefits including fractures and dislocations, medical fees, rehabilitation, hospital ICU, ambulance and physical therapy.

- Prosthesis Device (one) – $1,250

- Ambulance – $550

- ER Treatment – $325

- ER Observation – $100

- Physical Therapy – $60

- Wellness Benefit – $50

Video: Accident Insurance

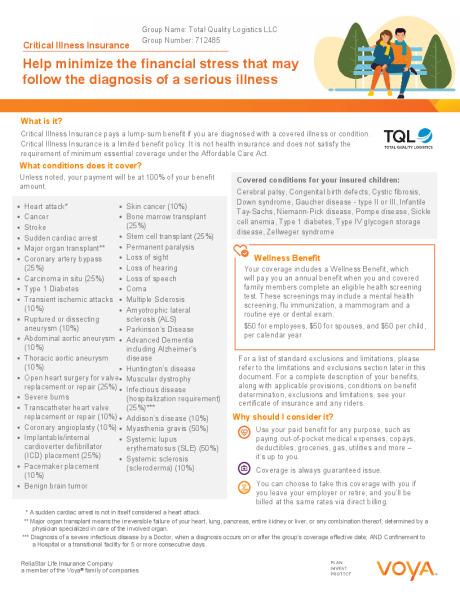

Voluntary Critical Illness Insurance

Critical Illness Insurance can help protect your finances from the expense of experiencing a serious health problem, such as a stroke, heart attack, or cancer. The benefit is elected by selecting a lump-sum benefit that would be paid directly to you at the first diagnosis of a covered condition. How you choose to use the benefit amount is up to you.

If you receive a full benefit payout for a covered illness, your coverage can be continued for the remaining covered conditions. The diagnosis of a new covered illness must occur at least 90 days after the most recent diagnosis. Each condition is payable once per lifetime.

Compass Critical Illness Insurance provides a lump-sum benefit following the diagnosis of a covered illness or condition such as heart attack, cancer, stroke, major organ transplant, coronary artery bypass and carcinoma in situ. This is a limited benefit policy and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act. You can use this benefit as you see fit to help navigate back to health and to work.

See also: Infectious Disease Insurance below as a supplement to Critical Illness Insurance.

Video: Critical Illness Insurance

Voluntary Infectious Disease Benefit (with Critical Illness Insurance)

Infectious Disease Insurance is now included with the Critical Illness Insurance offered at Crown.

Visit the Voya Claims Center at: voya.com/claims.

Group policy name: Total Quality Logistics, LLC

Group policy number: 712485

An Infectious Disease Benefit is now included with the Critical Illness insurance offered at Crown. This pays 25% of your Critical Illness benefit amount if you are diagnosed with a severe infectious disease that results in you being confined to a hospital for 5 or more consecutive days or a transitional facility for 14 or more consecutive days.

Reference the flyer below for more details about how to file a claim and requirements for Critical Illness to be qualified for Infectious Disease Insurance coverage.

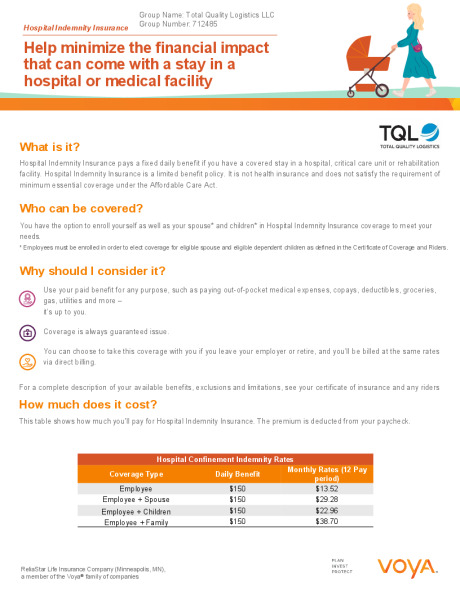

Voluntary Hospital Indemnity Insurance

Hospital Indemnity Insurance complements your health insurance by helping you pay for costs associated with a hospital stay. It provides funds for expenses your medical plan may not cover such as coinsurance or copays.

You may also purchase coverage for your spouse and dependent children.

Even a small trip to the hospital can have a major impact on your finances. Your plan may only cover a portion of what your stay entails.

Having Hospital Indemnity insurance from Voya means you will have added financial resources to help with medical costs or ongoing living expenses.

- Hospital Admission – $1,200 per admission

- Hospital Confinement – $150 per day

- ICU – $300 per day

- Observation – $250

Video: Hospital Indemnity Insurance

Voluntary Wellness Benefit

Wellness Benefit Insurance is offered through Voya.

Visit the Voya Claims Center at: voya.com/claims.

Group policy name: Total Quality Logistics, LLC

Group policy number: 712485

The Wellness Benefit provides an annual benefit payment if you complete a health screening test on or after your coverage effective date, whether or not there is any out-of-pocket cost to you.

The Wellness Benefit is included with

your Voluntary Accident and Critical Illness insurance, at no additional cost to you.