Which Medical Plan is Right?

Evaluate Your Needs. Consider your prior health care usage and select plans and options that fit your lifestyle and needs.

- Do you take regular prescription medications?

- Are you anticipating surgery or non-preventive dental care?

- Did you experience a qualifying life event this year?

- Review your current plans to ensure you have the coverage you need.

Review this benefits website to learn about your plan options.

A little bit of planning will help you select the best plans, coverage levels, and financial programs for your unique situation.

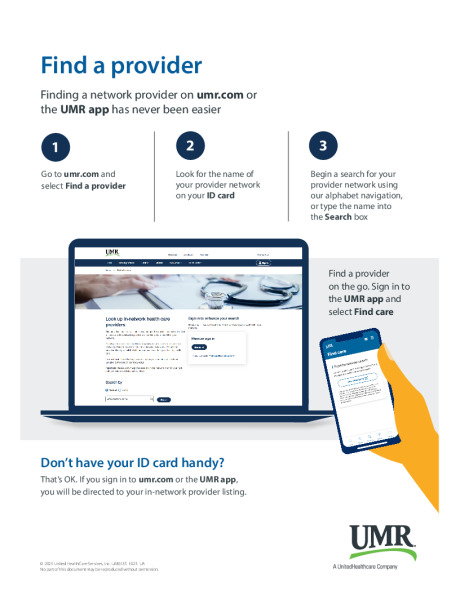

Make umr.com your first stop. You want managing your health care to be fast and easy, right? You got it. At umr.com, you’ll find everything you want to know – and need to do – as soon as you log in. No hassles. No waiting. Just the answers you’re looking for anytime, night or day!

Compare Medical Plans & Contributions

| PPO BASE PLAN | PPO BUY-UP | HDHP PREMIUM | HDHP BASIC | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IN NETWORK | OUT OF NETWORK | IN NETWORK | OUT OF NETWORK | IN NETWORK | OUT OF NETWORK | IN NETWORK | OUT OF NETWORK | |||||||||

| Annual Deductible | ||||||||||||||||

| Individual | $3,000 | $9,000 | $1,000 | $3,000 | $3,400 | $11,000 | $5,000 | $12,000 | ||||||||

| Family | $6,000 | $18,000 | $2,000 | $6,000 | $6,800 | $22,000 | $10,000 | $24,000 | ||||||||

| Coinsurance | 80% | 60% | 90% | 60% | 80% | 60% | 100% | 60% | ||||||||

| Maximum Out of Pocket | ||||||||||||||||

| Individual | $5,000 | $15,000 | $3,500 | $10,500 | $5,400 | $12,720 | $6,000 | $15,000 | ||||||||

| Family | $10,000 | $30,000 | $7,000 | $21,000 | $10,800 | $25,440 | $12,000 | $30,000 | ||||||||

| Preventative Care | ||||||||||||||||

| Adult Periodic Exams/Well Child Care | 100% | 60% | 100% | 60% | 100% | 60% | 100% | 60% | ||||||||

| Physician Office Visit | ||||||||||||||||

| Primary Care | $30 copay | 60% | $25 copay | 60% | Deductible, then covered at 80% |

60% | Deductible, then covered at 100% |

60% | ||||||||

| Specialty Care | $50 copay | 60% | $40 copay | 60% | Deductible, then covered at 80% |

60% | Deductible, then covered at 100% |

60% | ||||||||

| Teledoc | $10 | N/A | $10 | N/A | $10 | $10 | N/A | |||||||||

| Diagnostic Services | ||||||||||||||||

| Urgent Care Facility | $75 | 60% | $50 | 60% | Deductible, then covered at 80% |

60% | Deductible, then covered at 100% |

60% | ||||||||

| Emergency Room | Deductible, then $350 copay | 80% | Deductible, then $350 copay | 90% | Deductible, then $350 copay | 90% | Deductible, then $350 copay | 60% | ||||||||

| Inpatient/Outpatient | Deductible, then covered at 80% | 60% | Deductible, then covered at 90% | 60% | Deductible, then covered at 80% |

60% | Deductible, then covered at 100% |

60% | ||||||||

| Retail Pharmacy | ||||||||||||||||

| Generic | $20 copay | N/A | $20 copay | N/A | See *NOTE 1 below | N/A | See *NOTE 2 below | N/A | ||||||||

| Preferred | $40 copay | N/A | $40 copay | N/A | See *NOTE 1below | N/A | See *NOTE 2 below | N/A | ||||||||

| Non-Preferred | $100 copay | N/A | $100 copay | N/A | See *NOTE 1 below | N/A | See *NOTE 2 below | N/A | ||||||||

| Preferred Specialty | 25% - $500 | N/A | 25% - $500 | See *NOTE 1 below | N/A | See *NOTE 2 below | N/A | |||||||||

| *NOTE 1: Deductible, then PPO copay structure | *NOTE 2: Deductible, then PPO copay structure | |||||||||||||||

| Mail Order Pharmacy | ||||||||||||||||

| Generic | $60 copay | N/A | $60 copay | N/A | See *NOTE 3 below | N/A | See *NOTE 4 below | N/A | ||||||||

| Preferred | $120 copay | N/A | $120 copay | N/A | See *NOTE 3 below | N/A | See *NOTE 4 below | N/A | ||||||||

| Non-Preferred | $300 copay | N/A | $300 copay | N/A | See *NOTE 3 below | N/A | See *NOTE 4 below | N/A | ||||||||

| Preferred Specialty | 25% - $500 | N/A | 25% - $500 | N/A | See *NOTE 3 below | N/A | See *NOTE 4 below | N/A | ||||||||

| *Note 3: Deductible, then PPO copay structure | *Note 4: Deductible, then PPO copay structure | |||||||||||||||

| Employee Contributions (Semi-Monthly): Medical Plans | ||||||||||||||||

| PPO Base Plan | PPO BUY-UP | HDHP PREMIUM | HDHP Basic | |||||||||||||

| Employee | $74.98 | $154.72 | $48.71 | $10.00 | ||||||||||||

| Employee & Spouse | $168.51 | $356.19 | $107.89 | $52.57 | ||||||||||||

| Employee & Child(ren) | $129.11 | $273.56 | $83.18 | $42.91 | ||||||||||||

| Family | $237.35 | $497.02 | $151.58 | $74.88 | ||||||||||||